Digital transformation is not only modernizing business processes and workstyles, it’s also leading to an increase in security spending.

In its latest edition of its Worldwide Semiannual Security Spending Guide, IDC forecast that the global market for security hardware systems, software and services will total $81.7 billion this year, an 8.2-percent increase over 2016. By 2020, the analyst firm expects that figure to reach nearly $105 billion, representing a compound annual growth rate (CAGR) of 8.7 percent.

As businesses embark on digital transformation, they are adopting Internet of Things (IoT) devices, advanced analytics and other newer technologies that pose tempting targets for attackers. “The rapid growth of digital transformation is putting pressures on companies across all industries to proactively invest in security to protect themselves against known and unknown threats,” said IDC program director Eileen Smith in a statement.

Big spenders include financial firms and factories. “On a global basis, the banking, discrete manufacturing, and federal/central government industries will spend the most on security hardware, software, and services throughout the 2015-2020 forecast,” continued Smith. “Combined, these three industries will deliver more than 30 percent of the worldwide total in 2017.”

Process manufacturers, professional services firms and telecommunications companies are also high on the list of security solutions buyers. Each will spend in excess of $5 billion this year, according to IDC.

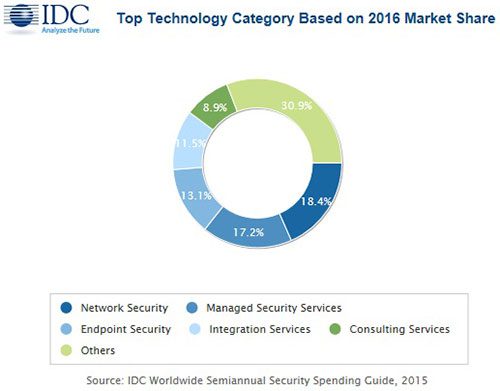

Like last year, businesses are flocking to network security hardware and software in 2017. Combined, the category will generate $15.2 billion in sales, earning it the top spot. In comparison, the third-place endpoint security software segment will attract $10.2 billion in revenues this year.

Through 2020, device vulnerability assessment software will be the fastest growing category with a CAGR or 16 percent, followed by software vulnerability assessment products (14.5 percent CAGR). Rounding out the top five are managed security services (12.2 percent CAGR), user behavioral analytics (12.2 percent CAGR) and unified threat management (UTM) hardware (11.9 percent CAGR).

The United States will spend the most on security products this year, to the tune of $36.9 billion. Western Europe is forecast to spend $19.2 billion.

“European organizations show a strong focus on security matters with data, cloud, and mobile security being the top three security concerns,” observed said Angela Vacca, senior research manager of Customer Insights and Analysis at IDC. “In this context, GDPR [General Data Protection Regulation] will drive up compliance-related projects significantly in 2017 and 2018, until organizations have found a cost-efficient and scalable way of dealing with data.”

Pedro Hernandez is a contributing editor at Datamation. Follow him on Twitter @ecoINSITE.